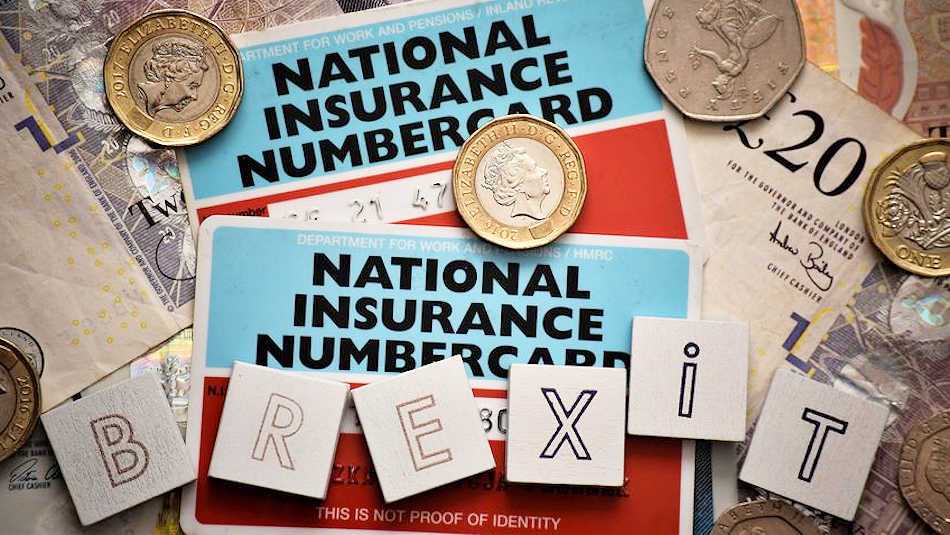

Second Brexit Special Employers Bulletin Issued By HMRC |

More clarity in case of a no-deal Brexit ... |

POSTED BY ROGER EDDOWES ON 07/10/2019 @ 8:00AM

HMRC has issued another Brexit special employers bulletin which relates to social security for employees sent to work in the EU, the EEA or Switzerland ...

The new Brexit Special employers bulletin gives more clarity on NI contributions post-Brexit!

The main takeaway from this new bulletin is that if the UK leaves the EU without an agreement, the existing EU Social Security Coordination Regulations, to ensure employers and workers only pay social security in one country at a time, will end.

"Employees will then need to make contributions in both the UK and the country that they are working in!"

If they have a UK-issued A1/E101 form, they'll need to continue to pay UK National Insurance for the length of time shown on the form. Should the date on the form be after the date the UK leaves the EU, the employer needs to contact the EU/EAA/Swiss authorities to confirm the levels of contributions that need paying there too. You can find details of these on the European Commission's own website by clicking here.

"Where the employee is a UK or Irish national working in Ireland, the good news is that their position does not change!"

Form A1/E101 will be replaced after Brexit, however, the same online form will be used to apply so any employees posted in the EU, EEA or Switzerland who wish to maintain their UK social security record can click here and reapply.

I suspect that the original reciprocal social security agreements that were in force before the United Kingdom joined the Common Market may be revived if there is a no-deal Brexit.

"We've got less than a month to discover which way things will go!"

If you'd like to find out more about this new Brexit Special employers bulletin then do give me a call on 01908 774320 or click here to ping me an email and let's see how I can help you.

Until next time ...

ROGER EDDOWES

Join our mailing list! Click here and be one of the first to know when we publish a new blog post!

Leave a comment ... |

More about Roger Eddowes ... | ||

|